Anaconda Mining sells Chilean iron ore assets to Hierro Tal Tal; Proceeds to assist in debt repayment

TORONTO, Dec. 7, 2011 /CNW/ – Anaconda Mining Inc. (“Anaconda” or “the Company”) – (TSX: ANX) is very happy to announce that, pursuant to an agreement dated today, it offers closed the sale of that Chilean iron ore exploration assets with a private Chilean company, Hierro Tal Tal S.A. (“Tal Tal”), for US$11 million in cash payments, a revenue royalty and a 1.25% carried interest in Compania Portuaria Tal Tal S.A. (“CPTT”). Using the cash proceeds received at closing of US$2 million, Anaconda will repay the total principal amount plus accrued interest of approximately $711,000 towards the holders on the Series III Debentures within 1 week of the closing. Also, the Company are going to pay other outstanding debt service obligations and vendor payables. Per the the share purchase agreement (the “SPA”), Anaconda will get another cash payment of US$2 million on May 31, 2012, that the Company expects make use of primarily to settle portions of other debts for example the Convertible Loan and also the Series I and II Debentures. All amounts are in Canadian dollars unless stated otherwise.

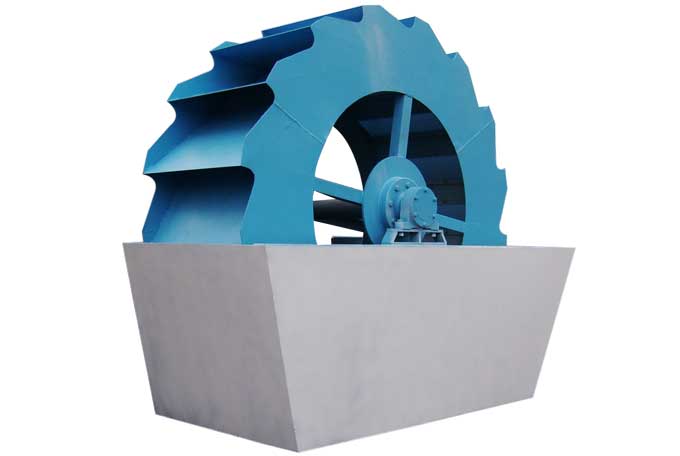

President and CEO of Anaconda, Dustin Angelo, stated, “The sale in the Chilean iron ore assets is an extremely positive step to the Company in realizing its long term strategic goals. The Company has sought a way to derive value from the iron ore assets while separating them from your gold asset, as well as the sale achieves those objectives. Anaconda can now focus its efforts on improving the performance of the Pine Cove mine and build off its recent success at the producing project. Furthermore, the business plans to pursue growth through exploration initiatives within the Pine Cove mining license. grinding mill for sale Anaconda will also evaluate expansion opportunities about the Baie Verte Peninsula as well as through corporate transactions or asset acquisitions of other gold assets throughout North America. In addition, the money infusion from the sale helps the Company improve its balance sheet. Together with the other US$2 million payment in approximately 6 months and cash flow from Pine Cove, Anaconda could potentially pay down a significant amount of its debt because of the summer 2012.”

Breakdown of the transaction:

Anaconda’s wholly owned subsidiary, Inversiones La Veta SpA (“La Veta”), sold its shares representing a 50% ownership stake in Minera Hierro San Gabriel S.A. (“MHSG”) plus a 20% ownership stake in Inversiones Hierro Antofagasta S.A. (“IHA”) to Tal Tal for approximately US$11 million in cash payments, ones US$2 million was paid at closing plus an additional US$2 million is due on May 31, 2012. La Veta will have the right to get an additional US$3 million upon achievement of economic production, as based on the SPA, by the properties, directly or indirectly, controlled by MHSG or IHA (the “Properties”). Gold Mining Equipment La Veta can earn nearly another US$4 million based on the sales price realized without a doubt volumes of production from the Properties, as defined in the SPA.

Get More Information

(If you do not want to contact us online, please fill out the following table, we will contact you as soon as possible. We will strictly protect your privacy.)