Silver news – Thomson Reuters GFMS’ Newman: Silver May Move Toward $50 Yet In 2011

Silver may yet move toward $50 an ounce this year as investors continue to seek it and gold as safe havens, with industrial demand for silver also likely to remain constructive, said Philip Newman, research director of precious metals with Thomson Reuters GFMS.

There could be some volatility in silver, he said in an interview with Kitco News on the sidelines of the annual London Bullion Market Association’s conference being held in Montreal this week.

“We think gold is likely, before the end of the year, to reach the $2,000 level,” Newman said. “That will see silver move higher, perhaps toward the $50 mark.

Silver is also maintaining underlying strength in industrial demand, Newman said.

“Silver is a little more diverse,” he said of its double role as an investment and industrial metal. “You have twin pillars.”

Gold has always had an important role for safe-haven demand among investors, but this is becoming increasingly significant for silver, Newman said.

“You have retail and high-net-worth investors coming into the market from the physical perspective, buying small bars and coins, (plus) ETFs,” he said. “That’s helping to push prices higher.”

For the year to date, global silver exchange-traded fund holdings are down slightly from the 600 million where they stood at the end of 2010, Newman said. But, he continued, the retreat has been “modest” and “they still remain at elevated levels and historically high levels.”

He anticipates a large percentage of these silver ETF holdings will be “quite sticky,” meaning investors will be willing to hang onto them for some time. “They have been purchased by small and high-net worth (investors) as a form of wealth preservation and asset diversification,” he said.

While industrial demand could suffer some in an economic downturn, Newman cited some resiliency.

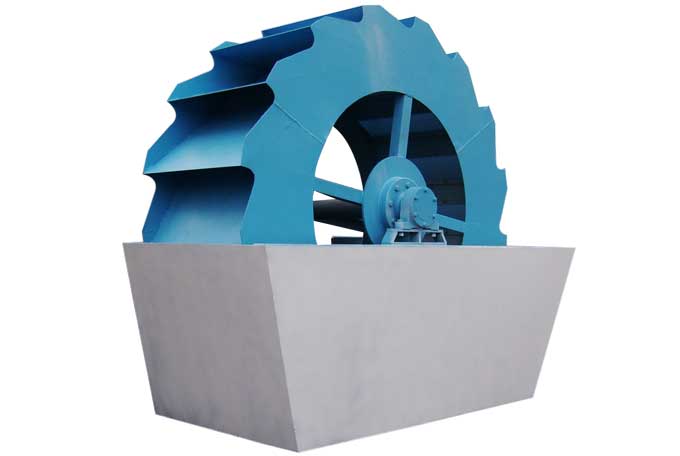

[Mining plant : hydraulic cone crusher primary crusher gold ore crusher machine ball mill grinder ]

“There is the potential for industrial demand to weaken, although we haven’t seen that just yet,” he said. “But there is always the risk if we have a double-dip recession emerge. The question is how sharply will it fall? It’s hard to see it falling to the extent that it did in 2009. That year, had the largest annual decline in the history of our (annual statistical) series. But then we saw the resilience of industrial demand the following year, when we had the largest annual rise in a single year.”

Some of the resilience is due to a wide range and growing number of uses, he said. For instance, a slowdown in the auto sector presumably means less silver demand for electrical contact points. However, the number of applications per vehicle—such as rear-parking sensors—is increasing.

“So the growing number of uses can partially offset a decline in auto sales,” he said.

Get More Information

(If you do not want to contact us online, please fill out the following table, we will contact you as soon as possible. We will strictly protect your privacy.)